Non-Fixed Deposit Savings Accounts That Pay 2% and More

Singapore Savings Account Rates blogspot dot com presents new update on non-fixed deposit savings and other banking accounts in Singapore today.

Singapore Savings Account Rates helps you to boost interest income from savings accounts, savings bonds and other financial retail investments in Singapore.

Singapore Savings Account Rates helps you to boost interest income from savings accounts, savings bonds and other financial retail investments in Singapore.

Non-Fixed Deposit Savings Accounts 2017 :

(1) DBS Multiplier Account: interest up to 2.68% p.a. on first $50,000.

You fulfil one or more of 5 transaction categories: salary credit, credit card spend, home loan instalments, insurance and investments.

(2) OCBC 360 Account: bonus interest on first $70,000.

You fulfil one or more transaction categories: credit salary (1.2% pa) , pay bills (0.3%pa), spend (0.3%pa), insure or invest (1.2%pa), save (1%pa).

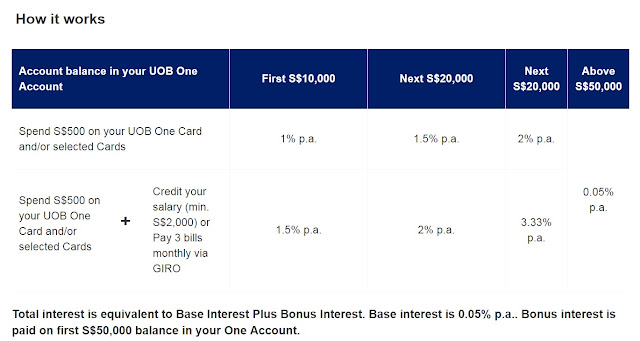

(3) UOB One Account: up to 3.33% p.a. interest. Bonus interest on first $50,000.

You fulfil one or more transaction categories: credit card, salary credit.

We limit ourselves to the 3 local banks for now. We shall provide more updates later as other banks introduce new promotions.

See also:

National Day Savings Promotion 2017

High Yield Savings Accounts 2017

July 2017 Fixed Deposit Promotions

Maybank iSavvy Savings Rate Update 2017

New SCB Fixed Deposit Update 2017

The Team