Highest Hybrid Singapore Savings Account Rates 2017

We look at the top three highest hybrid Singapore savings account rates from DBS, OCBC and UOB banks.

These are hybrid savings accounts. We call them "hybrid" because you don't just deposit money in these savings accounts and do nothing.

You need to work hard to earn extra interest. Like spend money using the bank's credit card, purchase insurance or investments distributed by the bank or transact GIRO payments with that bank or GIRO salary into your savings account. The more such services you perform, the better the rewards.

So let's go ahead and take a look at the following products.

Singapore Savings Account Rates blogspot dot com presents new update on savings and other banking accounts in Singapore today.

Singapore Savings Account Rates helps you to boost interest income from savings accounts, savings bonds and other financial retail investments in Singapore.

Singapore Savings Account Rates helps you to boost interest income from savings accounts, savings bonds and other financial retail investments in Singapore.

Highest Hybrid Singapore Savings Account Rates 2017 :

(1) DBS Multiplier Account: interest up to 2.68% p.a. on first $50,000.

You fulfil one or more of 5 transaction categories: salary credit, credit card spend, home loan instalments, insurance and investments.

(2) OCBC 360 Account: bonus interest on first $70,000.

You fulfil one or more transaction categories: credit salary (1.2% pa) , pay bills (0.3%pa), spend (0.3%pa), insure or invest (1.2%pa), save (1%pa).

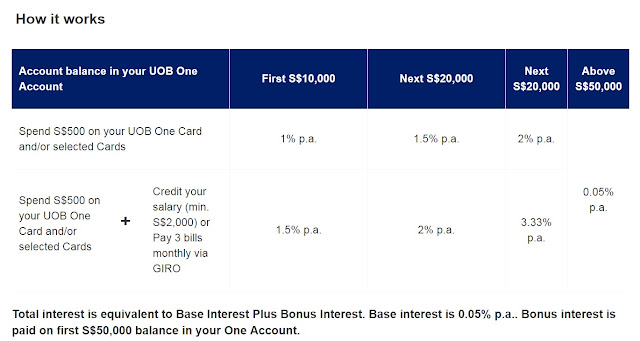

(3) UOB One Account: up to 3.33% p.a. interest. Bonus interest on first $50,000.

You fulfil one or more transaction categories: credit card, salary credit.

See also:

High Yield Savings Accounts 2017

Maybank iSavvy Savings Rate Update June-Aug 2017

New SCB Fixed Deposit Update June 2017

Safest Singapore Fixed Deposit Rate

BOC Fixed Deposit Promotion Rates

No hurdle 1.35% iSavings Account

Singapura Blue Sky Savers update

5% Savings Account For Kids

Rates quoted in 2017 on Singapore savings accounts rates are meant for personal use only. You are advised to check interest rates with the respective banks and/or fixed income investment companies before investing.

Thanks for reading Singapore Savings Account Rates.

The Team